Help Me Find A Financial Advisor

You may need help finding a financial advisor. Choosing a financial advisor is a big decision. How can consumers make a truly informed decision among advisors? It requires more time than most are willing to provide, leading consumers to rely upon shortcuts, going it alone or choosing a brand name, both of which will inexplicitly cost you and you may be surprised at the magnitude. You want to make an informed decision. In the following paragraphs, we offer some insight into our industry in the hopes it helps inform your decision.

From the outside all the work seems the same and it’s nearly impossible for you to know there are structural and regulatory differences among firms, let alone understand how those differences affect advisor behavior and your returns.

This is important. Even a healthy number of advisors themselves don’t understand this. Firms are certainly NOT all the same and it’s impossible for you to observe and even more difficult to understand. We hope to bring some clarity to the industry and make it more transparent for your benefit.

All firms must be regulated by a governmental body and register their firm. Firms choose to be registered as either a Broker/Dealer (BD) or as a Registered Investment Advisor (RIA). Confusingly, some register as both. If the firm is registered as a Broker/Dealer (regardless of any other registration), that firm is a Broker/Dealer. Period. True RIAs are only, or exclusively registered as an RIA.

Oddly, our industry may be the only industry operating with two standards of care. They are the “Best Interest” standard and the “Fiduciary” standard. Broker/Dealers adhere to the “Best Interest” standard and true RIAs adhere to the “Fiduciary” standard. The Fiduciary standard is a higher standard of care.

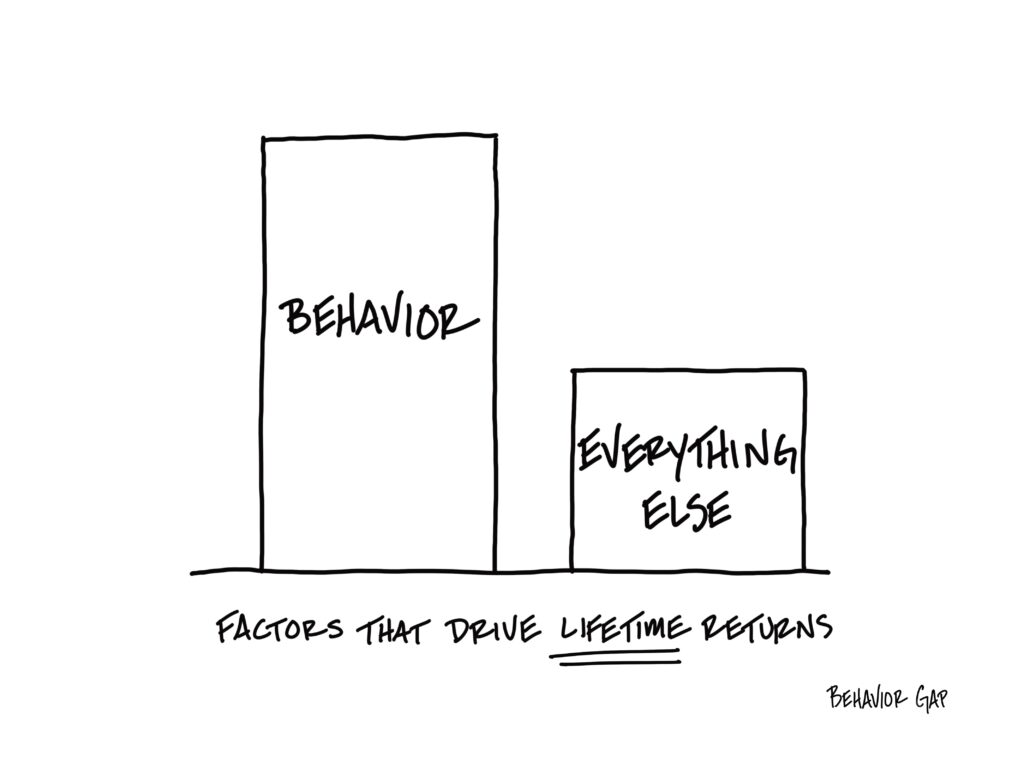

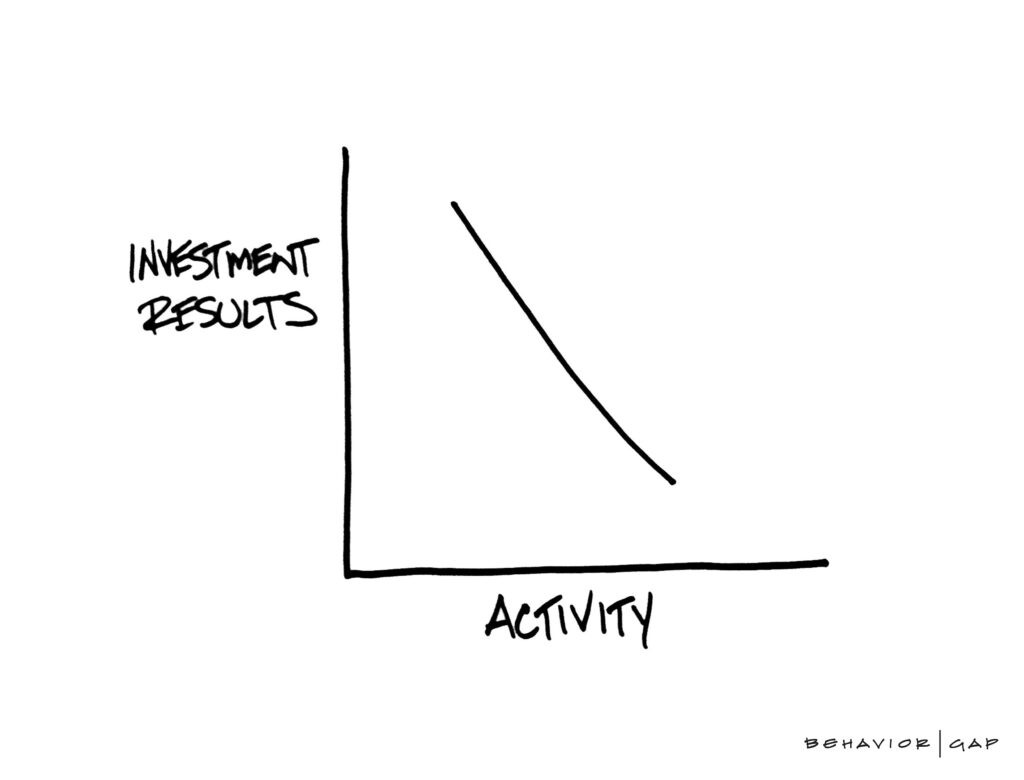

The standard of care a firm adopts greatly affects the behavioral patterns of its advisors. It affects whether or not products are sold to you, how investments are evaluated, selected for purchase or sale, or managed, and consequently, affects the returns you receive.

A proper financial advisors will help you to avoid behavioral mistakes.

Contrary to whatever is said, large brand name banks (Broker/Dealers) operate under the “Best Interest” standard and do not operate with complete objectivity. These facts affect the investment choices they make for you. Compensation influences decision making rather than your best interest. Actions speak louder than words. They are paid by sources other than you and that creates a conflict of interest. Why would advisor compensation be designed to be in conflict with clients? Are they working for you as the client OR are they working for shareholders? People tend to show loyalty to those who pay them. If they are paid by other sources how can they have complete loyalty to you? Your returns would be better if that were eliminated.

We are compensated in one way only – your fee. We are free of conflicts or influence – we make investment choices with only your best interest in mind – without other influence. This means better returns for you. This is greatly underappreciated – because the effects are hidden! Higher investment fees are not line items a person can observe on statements and neither is the cost of poor tax management of the portfolio. Both of these hidden costs manifest themselves (among other hidden opportunity costs) in lower returns. It’s completely opaque and difficult to recognize even for advisors. Without a fiduciary approach not only are your returns compromised, but the loyalty and duty you deserve are as well.

We are an RIA. We have high standards for our professional responsibility and conduct. We contractually agree to be fiduciaries to you. We put this in writing in the first line of our advisory agreement.

Does it make sense to create a portfolio when you don’t know the magnitude and character of the other assets and liabilities a person has? Does it make sense to create a portfolio without knowledge of a family’s plans or intentions? Does it make sense to create a portfolio if you don’t have some understanding of the discipline, investment experience, or behavioral tendencies of a person? These are considerations when determining what a portfolio should look like. If your Advisor doesn’t know your goals and intentions and what other assets you own, how is the portfolio reflective of your circumstances? However, most portfolios at large brand name banks are designed without this complete picture. How is this serving you as a client? We take seriously the process of understanding you and your family before we begin to consider allocations or investments. There is nothing worse than a prescription before a diagnosis.

We rely upon our multiple cycle experience, objectivity, and academic research to guide our process and choices. We consider your human capital and held-away assets when devising your portfolio or plan. We practice asset location, tax loss harvesting, tax gain harvesting, and if appropriate, use option strategies. Your portfolio will always be fee, tax, and inflation aware and efficient. This simple concept is incredibly important.

First, we do not sell you anything – ever. Further, how we evaluate, select for purchase or sale, and manage your investments, plus what we don’t do are the behavior patterns that will earn you advantages each year, compounding into significant differences over time. These differences are decidedly underestimated and underappreciated by most investors.

Especially when it comes to the portfolio – it’s not always what we do for you that is important, but what we don’t do that is equally or possibly even more important!

Is the Portfolio a Commodity?

Unfortunately, some believe the portfolio is a commodity. We disagree. It is easy to understand why this belief is growing. If you’ve never had a personalized experience, never felt genuine care from an advisor, and suffered through high fees, you likely experienced the old way of business – model portfolios – a great way for a large firm to scale, but a horrible way to receive a portfolio as a client. You can’t personalize the portfolios of thousands of clients! A handful of model portfolios is applied to all clients. Yes, that does sound like a commodity not worth paying for! We personalize each portfolio based upon your circumstances. Our decision process for selecting investments is far more thoughtful and rigorous, and we do more things inside the portfolio, for example, asset location, options strategies, tax loss harvesting, and tax gain harvesting. If you think a portfolio is a commodity, we can probably improve your outcomes.

Real wealth management is both financial planning and portfolio management. Please read more about our financial planning and portfolio management.

Every long journey begins the same way – with a single step. Take action. Please feel free to contact us. We answer questions with complete candor and transparency and we genuinely enjoy helping.