Portfolio Management

What is Portfolio Management?

Portfolio management is the process of understanding your family’s unique circumstances, future intentions, and risk characteristics first. Then, an appropriate asset allocation is determined – the proportional balance of asset groups with different risk (think stocks and bonds). And finally, evaluating and choosing individual assets to purchase while balancing your family’s desires and attitude toward risk with investment expectations to provide the best possibility of success.

Portfolio management is an ongoing process. We design a strategic portfolio for you first. We generally eschew market timing and turnover with tax implications, but life and markets are dynamic. Making a portfolio change due to a life circumstance change always makes sense. Reacting to the whims of the markets is rarely beneficial to your long-term goals, but on occasion it may be warranted. The marketplace for funds is always changing too, so investments, both existing and prospective, are evaluated and monitored for inclusion or exclusion from the portfolio.

Portfolio management is not just risk management and investments. We have a relationship. We expect healthy communication. Having a financial plan can be extremely beneficial to meeting your goals. Portfolio management is also about ensuring the planning and the portfolio are working in concert and serving the purpose of meeting your goals.

Taking it a Step Further – Behavioral Advice

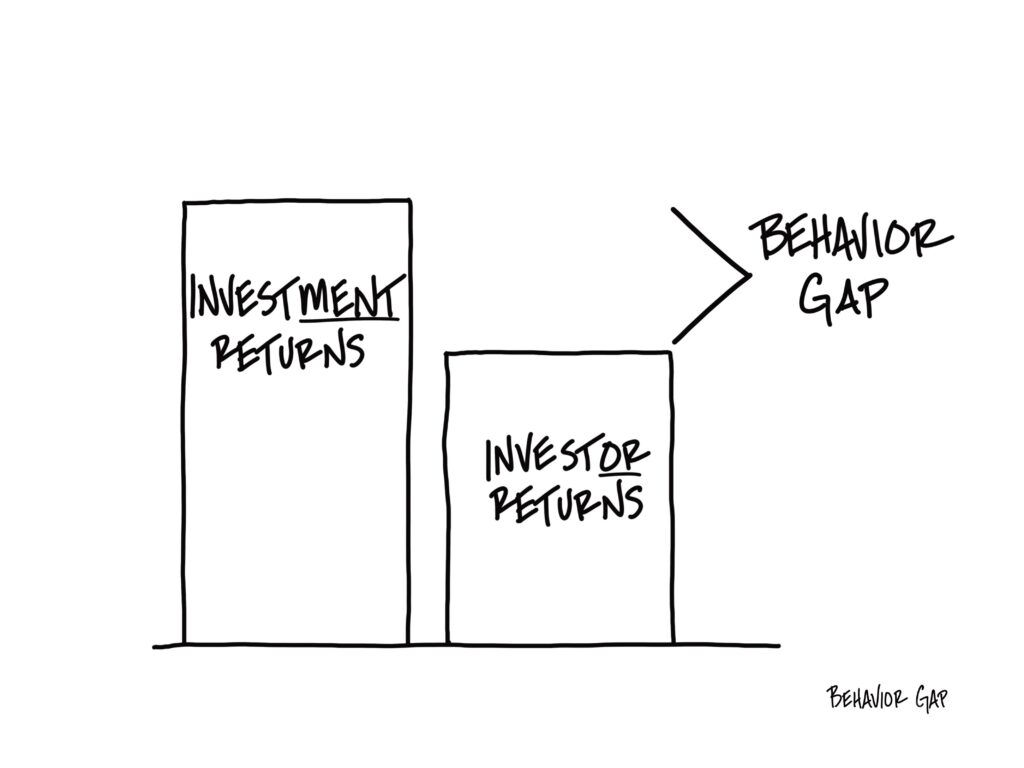

Our relationship can last decades and during that time there will be moments in life and in markets that will tempt you to make emotional decisions. It’s natural that emotions play a role in decisions – it’s just not rational. Much money has been lost and much opportunity missed because of cognitive or emotional biased decision making by individual investors. It happens. One poor decision can undo years of profits. As professionals, we pay special attention to behavioral biases. We’ve witnessed them firsthand and try our best to recognize when they are influencing a decision – yours or ours! We try to be proactive to prevent you from making biased decisions. Providing behavioral advice maybe the greatest source of value we offer in the relationship. Avoiding a big mistake is akin to scoring a big gain. We try our best to provide advice that avoids the damaging effects biased decision making can have on your future. We want you to make good, rational decisions.

Investors do not always get an investment’s full return due to cognitive and emotional biases.

Is the Portfolio a Commodity?

Unfortunately, some believe the portfolio is a commodity. We disagree. It is easy to understand why this belief is growing. If you never had a personalized experience, never felt genuine care from an advisor, and suffered through high fees, you likely experienced the old way of business – model portfolios – a great way for a large firm to scale and a horrible way to receive a portfolio as a client. You can’t personalize the portfolios of 1000’s of clients! A handful of model portfolios is applied to all clients. Yes, that does sound like a commodity not worth paying for! We personalize each portfolio based upon your circumstances. Our decision process for selecting investments is far more thoughtful and rigorous, and we do more things inside the portfolio, for example, asset location, options strategies, tax loss harvesting, and tax gain harvesting. If you think a portfolio is a commodity, we can probably improve your outcomes.

What we don’t do for you

Remember, its not always we we do for you that is important. What we don’t do for you is equally important!

Real wealth management is not only risk management, investments, and returns; financial planning is equally if not more important. We welcome you to learn more about our financial planning and to contact us. We answer questions with complete candor and transparency and we genuinely enjoy helping.